- Election years typically boost the S&P 500, with higher gains during Republican wins.

- But historical data shows macroeconomic factors often influence market outcomes more than elections.

- Goldman Sachs notes a potential Trump win could lead to deregulation and sector-specific impacts.

Regardless of your political leaning, election years are usually good for the stock market.

From 1928 to 2016, the S&P 500 gained 11.28% on average in the years Americans went to the polls. But a Republican win yielded a higher return at 15.3%. Sorry, Democrats! A Democratic win was still positive for the index, yielding 7.6% on average, according to Morgan Stanley.

The macroeconomic environment plays a role in the market’s outcome — perhaps an even bigger one than elections. The S&P 500 fell 9% in 2000 as the tech bubble peaked months before George W. Bush’s Republican win. Similarly, during the 2008 financial crisis, the index fell by 37.0% as the Democrats and Barack Obama won.

While no one can predict the future, we can speculate with some insight.

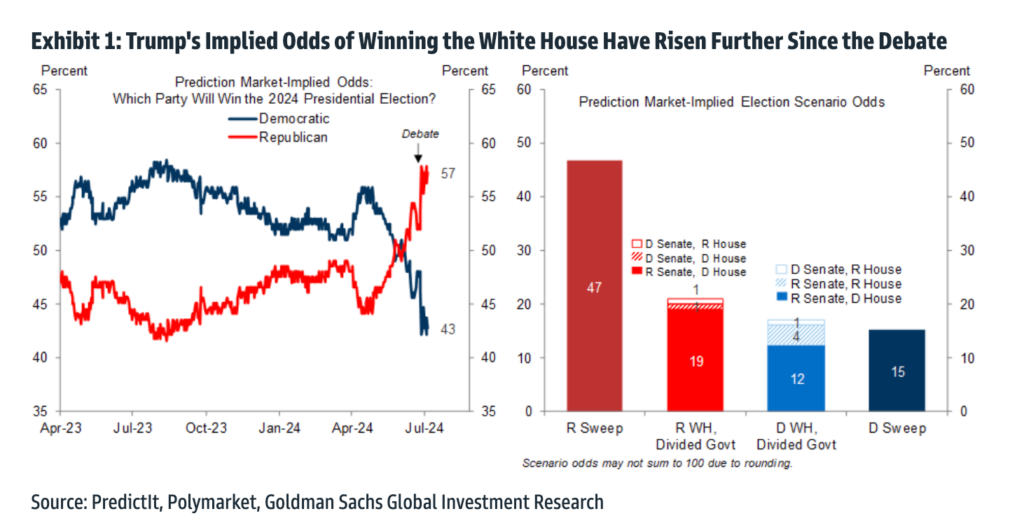

First, if you were on the fence about who might win this year's elections, a more probable outcome became a bit clearer after the presidential debate made headlines as disastrous for President Biden's campaign. This could increase the chances of a Trump win — at least, that's what the market thinks.

The two graphs below from a Goldman Sachs note on July 8 indicate what prediction markets perceive as each candidate's odds of winning following the debate. The left chart demonstrates a sharp reversal in expectations toward a Republican Presidency. The right graph predicts a majority Republican House and Senate, known as a sweep, which could further ease roadblocks around policy changes for a Republican presidency.

Despite November's results, the winner still faces fiscal limitations. But a Goldman Sachs note from July 8 suggests that a Trump win means setting in place a deregulation agenda, which would ease restrictions or what his administration refers to as "red tape" on certain industries. At least, that's what he has been advocating. Depending on what sector of the economy you're concerned with, it may or may not be a good thing.

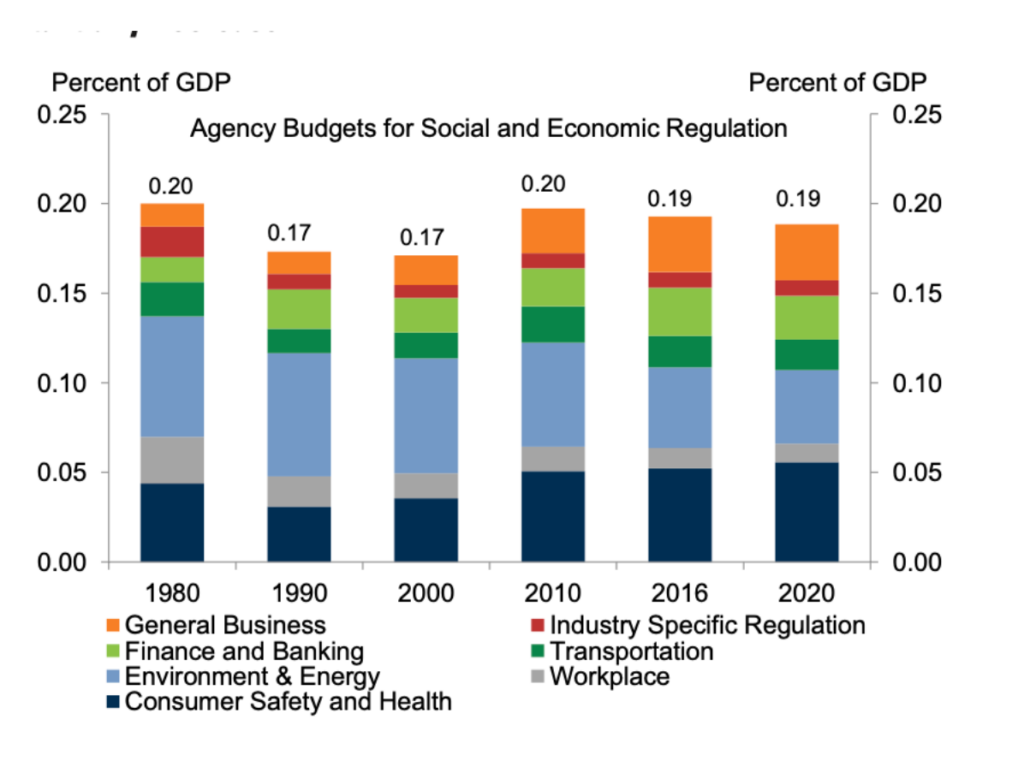

But what politicians say and what they do aren't always the same. So Goldman's team of analysts led by Jan Hatzius took score by looking back at Trump's presidency to determine how much restrictions were actually eased in the past. They found that while there were fewer rules created during his term, there wasn't much of a reduction in the overall number of them.

Simply put, sectors that had restrictions reduced were balanced out by other areas that saw increases. For example, the administration lowered vehicle fuel efficiency standards, cut environmental permits, loosened financial regulations, and removed restrictions on internet service providers' ability to limit access to certain users, known as net neutrality. On the other hand, it hiked restrictions on immigration, drug prices, as well as age restrictions and bans around nicotine products, read the note.

Goldman's analysts expect a second Trump victory to resemble the first, with a slight adjustment: more rollbacks on energy and environmental policies and financial regulations.

As for changes to budgets for social and economic agencies, there were limited differences between previous administrations and Trump's. The chart below shows the percentage of GDP allocated to each sector as demonstrated by the years. It demonstrates a minimal difference between 2010 and 2016, with the exception of a visible reduction in environmental and energy spending and a slight increase in finance and banking.

Investors wanting to reduce their exposure to political uncertainty may want to consider which sectors have the highest exposure to federal regulations. Goldman analysts believe that for better or worse, stocks within energy, utilities, financials, healthcare, industrials, materials, and telecommunications have high exposure. Although some players are set to gain and others lose, depending on the policies enacted. That pretty much sounds like all industries. But they do list areas with less exposure to be those under consumer discretionary and staples, technology, and real estate.

Within the energy sector, liquefied natural gas (LNG) is likely a clear winner. Goldman expects a change in Administration could allow the commodities to be exported again, which had been halted to non-Free Trade Agreement countries during the Biden Administration.

In the oil sector, Goldman expects oil leases on federal land and offshore energy development to expand.

For utilities, the bank believes restrictions on pollutants from fossil-fuel-electrical generation would be changed.

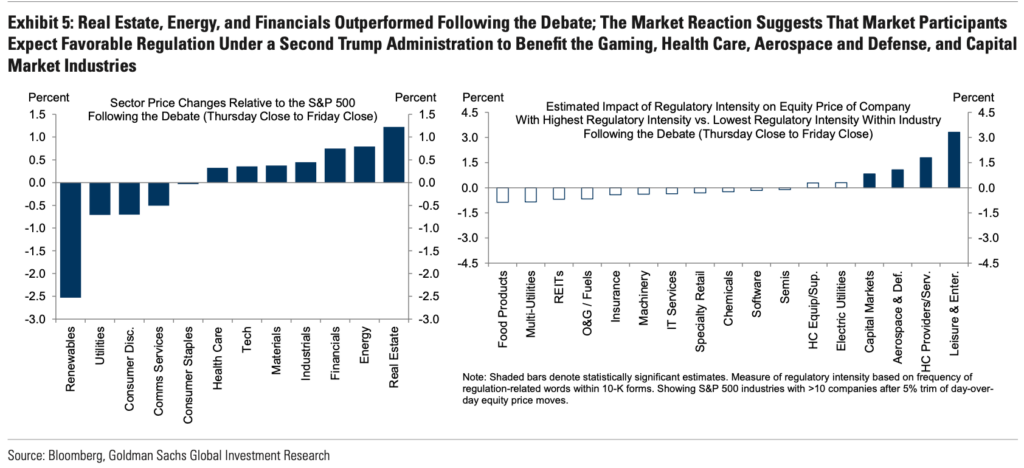

The equities market has its own expectations of what may do well and what may not. On that front, consumer discretionary stocks are perceived as riskier under a Trump administration due to the threat of increased tariffs. In comparison, renewables could see subsidy cutbacks. Both sectors underperformed relative to the S&P 500 during the 24-hour period around the debate, as demonstrated by the chart below. The graph on the right demonstrates sector performance relative to their exposure to regulation.